Like many farmers, you may see signs all around you that corn supply is robust and prices will stay low. Strong weekly crop condition ratings and a lack of significant weather issues this summer have been pushing prices lower since mid-June. And the most recent USDA crop report estimated both corn production and yield at record levels – not only well above pre-report industry expectations but also a sharp increase from the previous forecast – which sent prices down even further. What’s more, you likely pass fields of healthy corn every day. But the signs that you see aren’t the only ones that matter.

All other things being equal, the larger U.S. supply should keep pressure on prices heading into the new crop year. But all things aren’t equal. And U.S. supply isn’t the only factor that contributes to corn prices. In fact, as shown in figure 1, corn prices initially rose after the release of the August USDA report, before continuing lower. While it’s impossible to know whether that change represents a turning point or a temporary blip, it underscores the fact that other factors may be pulling prices in a different direction.

Corn Prices March – August

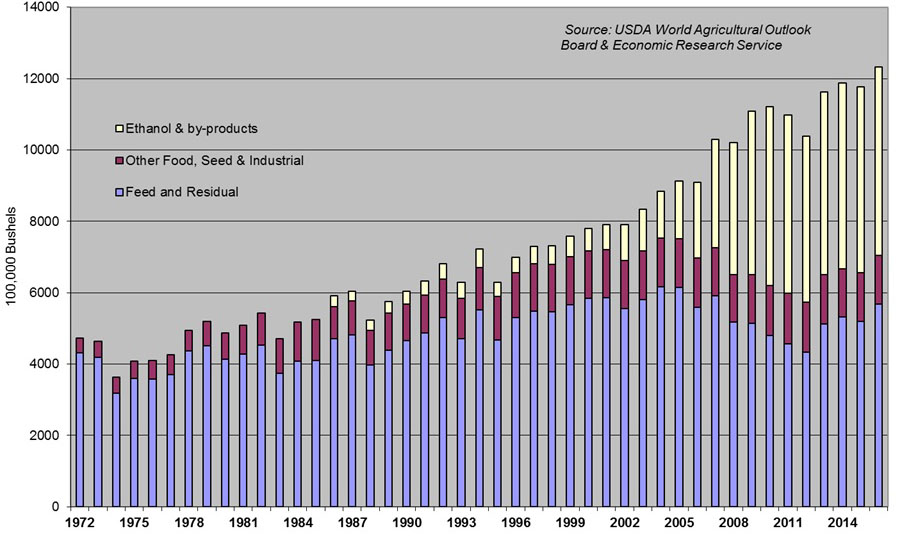

While you may see clear evidence of strong U.S. supply, remember to consider the demand side of the equation, as well as influences from outside the country. Along with adjustments to yield and production estimates, USDA’s August report also included increases in demand projections. As shown in figure 2, total domestic corn use has risen fairly steadily over the past 30 years, as a growing ethanol industry has made up an increasingly larger portion of demand. Although ethanol demand has been leveling off, estimates for domestic feed and residual usage were raised 475 million bushels, or 9.1%, over last year, leading to an increase in the 2016 estimate for total domestic use by 4.7% over 2015.

Total U.S. Domestic Corn Use

Annual U.S. Corn Shipments

No one can predict where corn prices will go, but history can serve as a guide. Currently, corn futures are in the second percentile of the past 10 years, as shown in figure 4. That means price levels have been lower only about two percent of the time during that time period. Even when compared against prices for the past 15 years, which includes marketing seasons before ethanol production was a significant factor in demand, today’s futures price level is still well below average.

Historical Percentiles for Dec 16 Corn Futures Prices

Given the possibility that corn prices may rise, one solution would be to commit to fixed purchases at current price levels by using futures contracts. While that would lock in a relatively low cost for your corn inputs, if prices fall, you would miss out on the opportunity to get an even lower price. If you’d like to take advantage of today’s low prices, while also leaving open the possibility of benefitting from further declines, you may want to consider option strategies. By purchasing a call option, you secure the right – but not the obligation – to buy corn at a given price. In other words, you commit to a maximum price, but not a minimum. In this way, options represent a tool for adding valuable flexibility to your risk management plan.

If options were free, the decision about what to do would be straightforward. But the right strategy for your situation will depend on a number of factors, including the cost of the options themselves. Because an option affords some degree of certainty, the greater the level of overall uncertainty in the market, the more valuable a given option will be. By quantifying the relative cost of options – how expensive they are compared to the benefit they offer – we can make an informed decision about whether an option strategy makes sense for your situation.

While the nominal cost of options will vary based on futures price levels and largely be a function of price changes in the underlying futures market, the relative cost of options reflects the level of uncertainty in the market. This measure displays seasonal tendencies; historically it tends to increase from mid-September to late November, perhaps as a result of increased uncertainty during the harvest season. By that measure, December corn options are trading at close to 10-year lows for this time of the year. That means they are effectively available for a discount. What’s more, because options have value until the day they expire, you can further reduce your net sunk costs by making adjustments – buying or selling options – as the market moves. In that way, you can not only protect your corn price level, you can also leverage market volatility for incremental gains that improve your bottom line.

Be Cautious, Not Complacent

Although this year’s corn crop is likely to be large (and a welcome development for livestock producers and other buyers), it is important to not grow complacent with the market. Remember that the view around you won’t last forever, and is just a piece of the whole corn market picture.

Options may help you add valuable flexibility to your risk management plan, allowing you to both protect yourself from price increases and take advantage of declines. But using options isn’t a simple yes-no decision. You also need to consider how much of your exposure to hedge, when to act and when to sit tight. If you have questions about whether an option strategy can help you gain more control over your bottom line, please contact Commodity & Ingredient Hedging at 1.866.299.9333.