Many dairy producers have questions regarding the new government Margin Protection Program including if they should sign up for it and how it will work to protect their profitability in coming years. This paper seeks to answer some of those questions with facts about the mechanics of the program and how it may be incorporated by a dairy as part of a larger margin management plan in their operation.

Background – What is MPP?

The Margin Protection Program was implemented as part of the Agricultural Act of 2014 to provide an improved safety net for dairy producers in the new Farm Bill. It is a voluntary risk management program designed to provide financial assistance to dairy producers during periods of catastrophic, industry-wide losses when the difference between the price of milk and the cost of feed falls below certain thresholds. The program replaces the former Milk Income Loss Contract (MILC), although the Livestock Gross Margin for Dairy (LGM) program was extended as the safety net provisions in the new Farm Bill move more towards subsidized insurance products and away from direct payments. The Margin Protection Program will run for the length of the new Farm Bill, and should a dairy producer choose to participate in MPP, they forego the option to participate in LGM.

How to Calculate the Margin in MPP:

The Milk Income Over Feed Cost calculation is determined by taking the U.S. All Milk Price as reported monthly by NASS and subtracting the following components from that price:

- NASS Corn Price * 1.0728

- AMS Soybean Meal Price * 0.00735

- NASS Alfalfa Price * 0.0137

The Income over Feed calculation is based off of national average cash prices reported by USDA and not CBOT or CME futures values. The prices cannot be customized by state or region. Additionally, the reported corn, soybean meal and alfalfa prices are those received by producers and therefore do not take into consideration offers paid by buyers such as dairies using these commodities. The margin will be calculated by taking a consecutive two-month average milk price and subtracting the corresponding two-month average feed cost from that price. The two-month averaging periods are as follows:

- January-February

- March-April

- May-June

- July-August

- September-October

- November-December

Indemnity payments will be determined in the month following each two-month calculation, with payments made early in the following month. In other words, indemnity payments due based off the January-February average will be determined in late March with producer payments following in early April. The two-month average must fall below an insured threshold in order to trigger an indemnity payment. If for example the January average margin is below a threshold yet the February margin is not, with the January-February average margin also not below the threshold, no indemnity payment will be made.

Important Program Features:

The enrollment period for both calendar year 2014 and 2015 runs from September 2 through November 28, and producers may sign up through their local USDA Farm Service Agency (FSA) offices. For 2016-2018, the signup period will commence on July 1 of the preceding coverage year and run through September 30. This means that producers will have from July 1-September 30, 2015 to decide at what percentage of production and level of coverage they wish to participate in MPP for calendar year 2016.

Producers may elect to insure from 25% up to 90% of their historical production, calculated as the highest level of production achieved in 2011, 2012 or 2013 in 5% increments. They may purchase margin coverage from $4.00/cwt. up to a maximum of $8.00/cwt. in 50-cent increments. The first 4 million pounds of production will be offered at reduced premiums that are discounted 25% for 2014 and 2015 up to the $7.50/cwt. level. No discount is offered at the $8.00/cwt. level. Production in excess of 4 million pounds can also be covered at higher premiums with no discount offered for 2014 or 2015. Premiums will remain fixed for the duration of the current Farm Bill, regardless of where margins are calculated in subsequent years. Coverage may not be “laddered”, meaning that a producer cannot elect to insure a certain percentage of their production at one level and a different percentage at another. Coverage is free for margin protection at the $4.00/cwt. level, with the following schedule detailing the cost for the various levels up to the maximum insurable margin at $8.00/cwt.

Payments may either be made in full at sign-up, or a minimum of 25% due by February 1 with the 75% balance due no later than June 1. Producers who have not paid their premiums by the deadlines will be considered in default, and will not receive indemnity payments until they have corrected the situation. Another feature of MPP is that a dairy donation program will be triggered if the calculated margin falls below $4.00/cwt. for any two consecutive months, with the Agriculture Department publishing a list of consumer-ready dairy products to be purchased at market prices. The purchased items will be donated to food banks and other low-income feeding programs, with the Agriculture Department prohibited from storing the purchased items and the receiving parties prohibited from reselling the donated items back into commercial markets.

How Does MPP Relate to My Profit Margin?

The MPP margin is an income over feed equation and does not include operating costs. The actual margins for individual dairy operations associated with the various insurable levels will vary based upon the different operating costs and non-feed expenses unique to the particular dairy. The actual margin a dairy receives will further depend on their particular milk paymentformula as the NASS All-Milk price does not take into consideration PPD, California Overbase, or components unique to an individual dairy. The actual margin a dairy receives will also depend on their particular feed to milk ratio, which may differ from the MPP ratio implied by the formula. The MPP formula implies the following contributions to the dairy feed ration:

- Corn – 49%

- Soybean Meal – 27%

- Alfalfa Hay – 24%

Another point regarding the ration is that the individual dairy’s feed ration may also experience seasonal variation, which would further change the actual income over feed margin on the farm in any two-month period relative to the MPP calculation. Given these considerations, it is important for a dairy producer to understand how their actual profit margin has varied historically from the margin calculation in the MPP formula, and what the various insurable margin thresholds have corresponded to in actual profit margins over time.

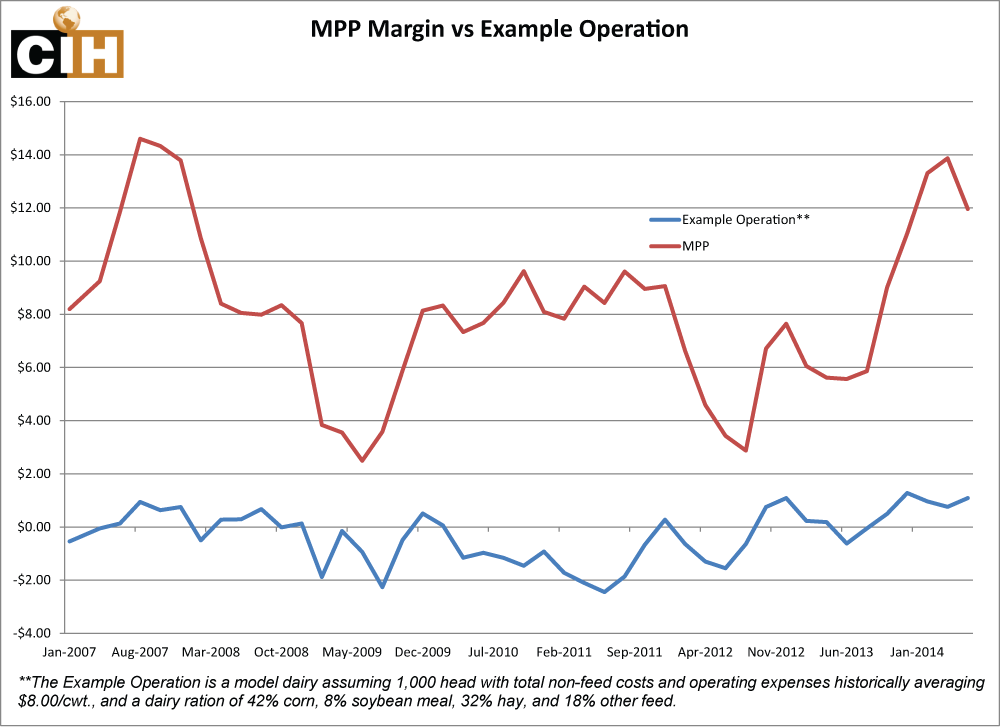

As a simple example, let us consider a model dairy operation that milks 1,000 head with total non-feed costs and operating expenses historically averaging $8.00/cwt., and a dairy ration of 42% corn, 8% soybean meal, 32% hay, and 18% other feed. Considering at first only the impact of the $8.00/cwt. non-feed costs, we can immediately see that if we were to utilize the MPP’s highest, $8.00/cwt. insurable margin threshold, it would roughly translate to protecting a breakeven margin on this particular dairy (not including the premium cost). Furthermore, if we now consider the variation of the model dairy’s ration from MPP, we can see that the one size fits all margin of the MPP may not perfectly protect this operation. For example, since the model dairy operation uses more hay than MPP’s assumptions, if hay prices increase we will only be partially protected from the price rise. Likewise, because this operation is using less meal and corn than the MPP assumptions, if those prices fall the MPP margin will improve more than this particular model dairy, creating another potential mismatch in coverage. The impact on margins from both of these factors including the non-feed costs can be seen in the following chart comparing the historical MPP to that of our model dairy operation:

Should I Sign Up for MPP?

Though the MPP may not perfectly hedge your operation and only provide protection at low margin levels, with the government providing free disaster insurance to protect against a severely negative margin event, it would seem prudent to at least participate at that level through the duration of the current Farm Bill. This would entail paying a minimum $100 administrative fee in each year through 2018. Whether or not to insure above the $4.00/cwt. margin threshold and pay additional premiums to obtain that insurance will be a function of forecasted margins for the particular coverage year. The Agriculture Department has developed an online tool to help dairy producers forecast forward margins which can be accessed by clicking here.

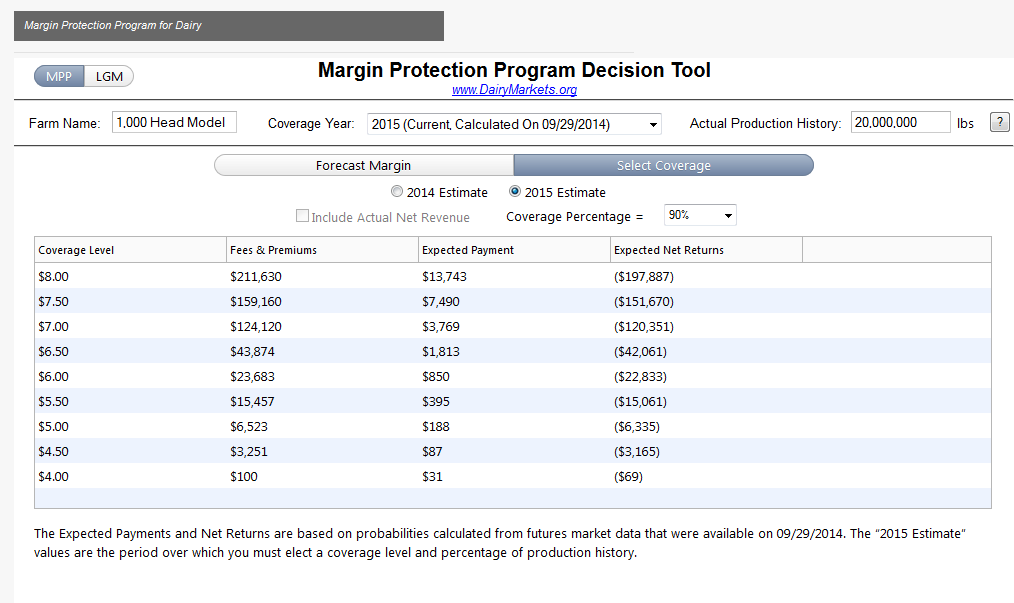

After agreeing to a disclaimer, you will be taken to a page that looks like this:

The Margin Protection Program Decision Tool basically uses futures prices to estimate the forward margin calculation in the MPP formula, with the graph for 2015 displayed above. Given that the MPP Income over Feed calculation is based off USDA average monthly cash prices as reported by NASS and AMS, there is a margin for error associated with using exchange-traded futures prices to forecast forward MPP Income over Feed values. This is represented by the probability bands around the black line in the graph. By changing the coverage year in the drop-down menu at the top of the page, you can see how actual margins in previous years differed from what was forecast at the end of September the year before. The end of September forecast for the following year would correspond to the last day you would have had to elect coverage levels for the upcoming year had the program previously been in effect. The graph for 2015 depicted above forecasts that margins are expected to stay above $8.00/cwt. level which is the highest insurable threshold that can be elected – even taking into consideration the lower probability band.

As a general note, paying for supplemental insurance above the $4.00/cwt. minimum threshold that is offered for free will appear more favorable when forecasted margins are expected to fall within the insurable range and less favorable when they do not. Also, because the premiums will remain fixed through 2018, paying added premium to insure a higher margin threshold will be more advantageous during a low margin period and less advantageous during a high margin period. Another way of thinking about this is to calculate “expected net returns” by choosing different coverage levels at a given percentage of production. If you change the graph from “Forecast Margin” to “Select Coverage”, the decision tool will take you to a table where you can view the expected net returns for the various levels of coverage. This basically will take into consideration the cost of your premium against the probability of receiving an indemnity payment given the forecasted forward margins so you can make a more educated decision on what level of additional coverage (if any) you may elect to insure should you decide to sign up for MPP. The screenshot below displays this view:

As you can see, the expected net returns for all coverage levels in 2015 is negative which makes sense as the forecasted margin is expected to stay above the maximum insurable level of $8.00/cwt. Given this forecast, a dairy might reasonably conclude that it may not be advantageous to elect coverage beyond the minimum $4.00/cwt. minimum level in calendar year 2015 – at least based upon the current forecast. This may, however change by late November when a dairy has to make a final decision for next year.

It is important to understand though that the margin being forecast for next year and the actual margin to be realized in 2015 can be drastically different depending on how market conditions unfold over time. Just because the expected net return at any given coverage level is negative based on the current forecast doesn’t mean that the actual return will turn out negative. There remains risk that what is being forecast may not play out with reality depending on how milk prices and feed costs change between now and next year. As with any insurance product, you purchase insurance to protect against a negative outcome. Just as you would not want to file a claim to “get value back” from your policy in the event of a loss, determining not to purchase additional coverage at higher levels of margin protection should not be made solely on the basis of a negative expected return.

How Do MPP Premiums Compare to Prices on the Exchange?

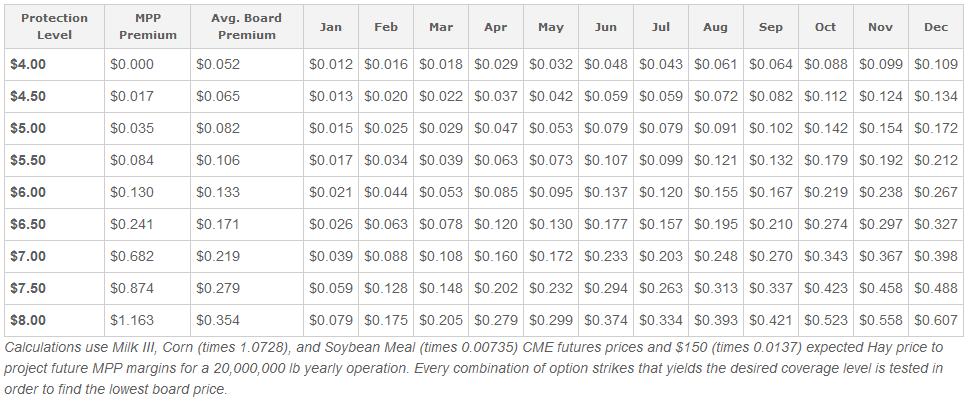

The Margin Protection Program as an insurance policy can be related to using exchange-traded options which would protect both higher feed costs and lower milk prices simultaneously in a margin management strategy. We have received many questions regarding how the costs and benefits of the Margin Protection Program compare with using the exchange independently. In order to calculate what it would cost to protect MPP protection levels on the board, we must compare the MPP cash prices to board equivalents. For the sake of simplicity in this example, we assume that NASS milk can be substituted with CME Class III Milk (plus $2.00 due to the historical price difference), NASS Corn with CBOT Corn, AMS Soybean Meal with CBOT Soybean Meal, and that the price of Hay remains constant at $150/ton (given that there is no equivalent exchange contract). Using these assumptions we can figure out prices on the board for combinations of purchased options over the course of the next year that would protect approximately the same margin levels as the MPP program. A comparison of the MPP premiums for a 1,000 head dairy to the costs of the same protection on the board follows. (Note: These calculations as of September 30, 2014)

As you can see, under the assumptions of this example, it would currently be cheaper to purchase similar protection on the board for 2015 than using the MPP program for all but the lowest coverage levels (below $6.50/cwt.), although this might change by late November.

Conclusion:

The Dairy Margin Protection Program addresses the principal risk dairies face, which is the possibility that the cost of producing milk exceeds the value of that milk production in the marketplace. CIH embraces any tool that can be used to help our clients reduce their risk exposure, and MPP represents an attractive alternative to accomplish this – particularly at lower margin levels. Furthermore, in years where margins are projected to be low, it may be worthwhile to utilize MPP at its higher levels of margin protection. However, a producer must also be aware of how their specific operation relates to the assumptions in the MPP program in order to create an integrated margin management policy to ensure that they are properly hedged and that they are taking advantage of protecting opportunities above the levels that MPP offers. CIH provides the tools to compare various protection alternatives and to tailor a plan to meet your specific operation and needs. We encourage you to learn how a combination of risk management alternatives can help you better protect forward margins in your unique dairy.